4 7 Prepare Journal Entries for a Job Order Cost System Principles of Accounting, Volume 2: Managerial Accounting

But note that while production facility electricity costs are treated as overhead, the organization’s administrative facility electrical costs are not included as overhead costs. proforma invoice template Instead, they are treated as period costs, as office rent or insurance would be. The remaining hours are the total hours spent by one employee as indirect labor utilization.

Conversion Costs: Definition, Formula, and Example

- However, since employees are going to work on the raw materials to transform them into a sellable product, you need to add their wages to the WIP account.

- The costs assigned to job MAC001 are $300 in vinyl, $100 in black ink, $60 in red ink, and $60 in gold ink.

- The accuracy of the rate is important because it is used throughout the year and any underapplied or overapplied overhead is closed out to Cost of Goods Sold at the end of the year.

- We will use the beginning inventory balances in the accounts that were provided earlier in the example.

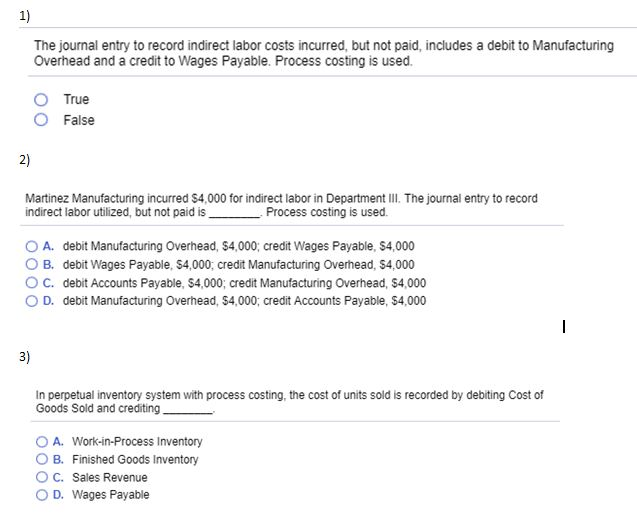

- The accounting treatment of indirect labour costs is similar to the accounting treatment of direct labour, excluding one main difference.

Along with these direct materials and labor, the project will incur manufacturing overhead costs, such as indirect materials, indirect labor, and other miscellaneous overhead costs. In order to set an appropriate sales price for a product, companies need to know how much it costs to produce an item. Just as a company provides financial statement information to external stakeholders for decision-making, they must provide costing information to internal managerial decision makers.

THE ROLE OF DIRECT AND INDIRECT LABOR COSTS

Shortly after taking over her new position as divisional controller, she was asked to develop the division’s predetermined overhead rate for the upcoming year. The accuracy of the rate is important because it is used throughout the year and any underapplied or overapplied overhead is closed out to Cost of Goods Sold at the end of the year. National Home Products uses direct labor-hours in all of its divisions as the allocation base for manufacturing overhead.

Direct Materials Requisitioned by the Shaping and Packaging Departments and Indirect Material Used

Indirect labor cost is the cost of labor that is not directly related to the production of goods and the performance of services. It refers to the wages paid to workers whose duties enable others to produce goods and perform services. The job cost accounting journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of job costing. On the other hand, certain compensation packages can vary depending on the company’s production and schedule. For instance, an accountant who gets paid on an hourly basis might need to work overtime during periods of increased activity. In this case, the employee’s compensation is directly linked to the volume of business activity, which makes it a variable cost for the employer.

Overapplied Overhead

For example, the wages of a team of workers that performs their tasks solely on the job A can be directly traced to job A. You don’t need to modify liabilities since this is just a transfer of assets from one asset account to another. However, since employees are going to work on the raw materials to transform them into a sellable product, you need to add their wages to the WIP account.

7 Prepare Journal Entries for a Job Order Cost System

It is much more practical to track how many pounds of nails were used for the period and allocate this cost (along with other costs) to the overhead costs of the finished products. Direct labor is the total cost of wages, payroll taxes, payroll benefits, and similar expenses for the individuals who work directly on manufacturing a particular product. The direct labor costs for Dinosaur Vinyl to complete Job MAC001 occur in the production and finishing departments. In the production department, two individuals each work one hour at a rate of $15 per hour, including taxes and benefits. The finishing department’s direct labor involves two individuals working one hour each at a rate of $18 per hour.

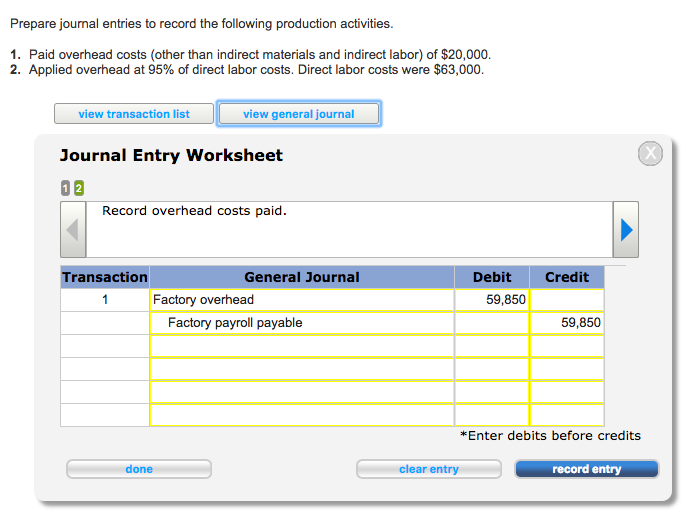

As the overhead costs are actually incurred, the Factory Overhead account is debited, and logically offsetting accounts are credited. You have a team of laborers that work on the watch during that time whose salaries total $5,000, which means this is a case of inventory that starts as raw materials, becomes works in progress, and finishes as inventory and COGS. Since indirect labor cannot be traced back to a specific product or service, the related cost can’t be billed to the goods produced or the services rendered. It represents the overhead to the business needed to support the level of operations. Direct labor cost is the labor cost that the company can directly trace to a single job or unit of product that has been performed or produced during the period.

The company can make the labor cost journal entry by debiting the labor cost account and crediting wages payable account and payroll taxes payable. These illustrations of the disposition of under- and overapplied overhead are typical, but not the only solution. A more theoretically correct approach would be to reduce cost of goods sold, work in process inventory, and finished goods inventory on a pro-rata basis. However, this approach is cumbersome and occasionally runs afoul of specific accounting rules discussed next. At its core, inventory is nothing more than raw materials purchased by the company and transformed into a sellable product or service. The way this plays out on the balance sheet is that raw materials are added as a current asset — but NOT yet inventory — and accounts payable is credited.

The one major difference between the home builder example and this one is that the tax accountant will not have direct material costs to track. They are usually split into direct and indirect labor costs, based on the worker’s contribution to the production process. While direct labor comprises work done on certain products or services, indirect labor is employee work that can’t be traced back or billed to services or goods produced.

Bình Luận