Debits and Credits Cheat Sheet: A Handy Beginner’s Guide

Imagine that you want to buy an asset, such as a piece of office furniture. So, you take out a bank loan payable to the tune of $1,000 to buy the furniture. Debits and credits seem like they should be 2 of the simplest terms in accounting. The majority of activity in the revenue category is sales to customers.

- For example, if you stock up on new inventory, more resources are coming into your company.

- In this system, only a single notation is made of a transaction; it is usually an entry in a check book or cash journal, indicating the receipt or expenditure of cash.

- Use the cheat sheet in this article to get to grips with how credits and debits affect your accounts.

- Fortunately, federal governments have put stronger consumer protection laws in place to protect cardholders.

Establishing Physical Inventory Controls

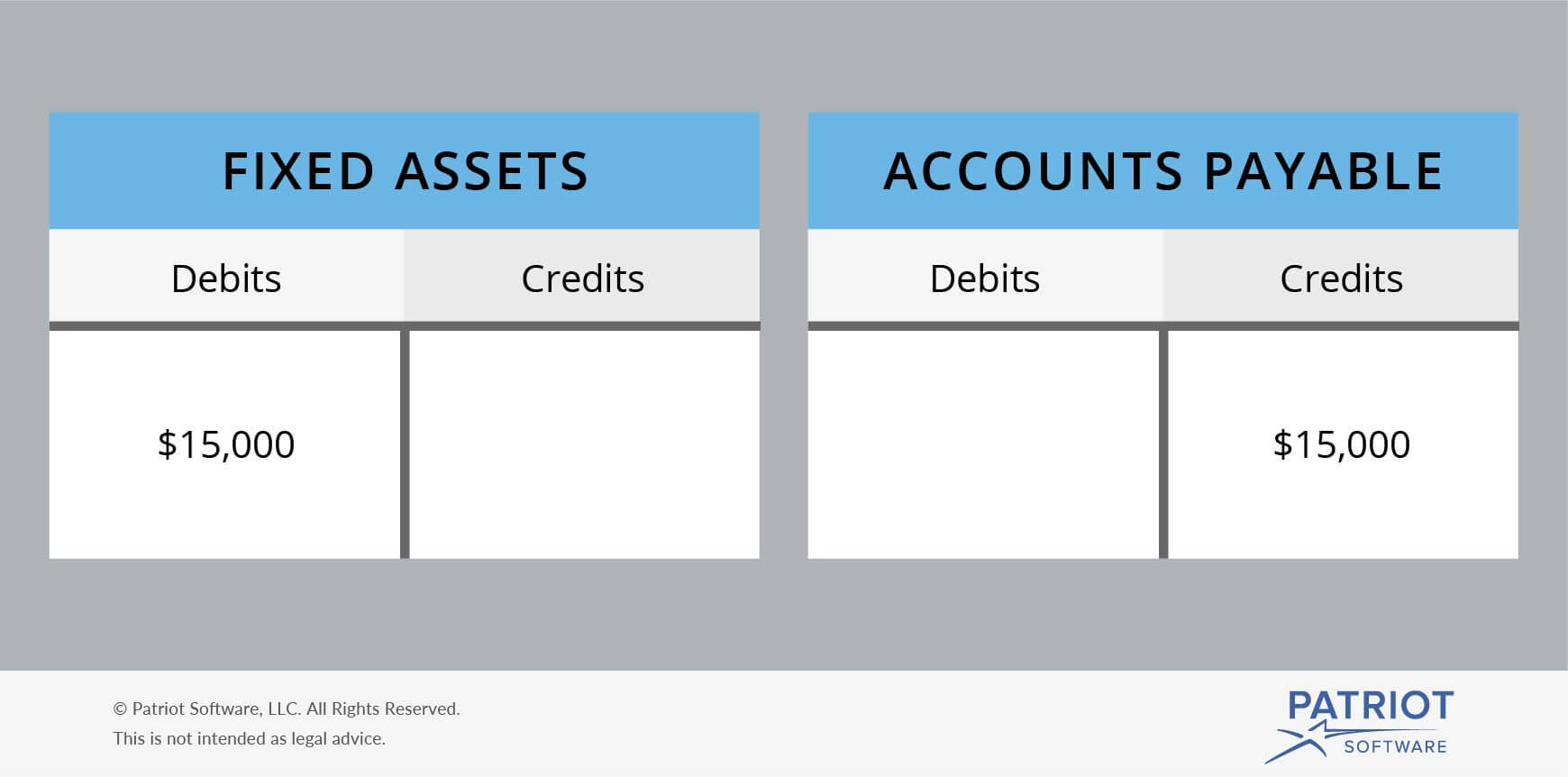

This includes costs incurred for promoting products or services to potential customers. Revenue accounts are accounts related to income earned from the sale of products and services. Then, credit your Accounts Payable account to show that you owe $1,000. The formula is used to create the financial statements, and the formula must stay in balance. You’ll notice that the function of debits and credits are the exact opposite of one another. Before getting into the differences between debit vs. credit accounting, it’s important to understand that they actually work together.

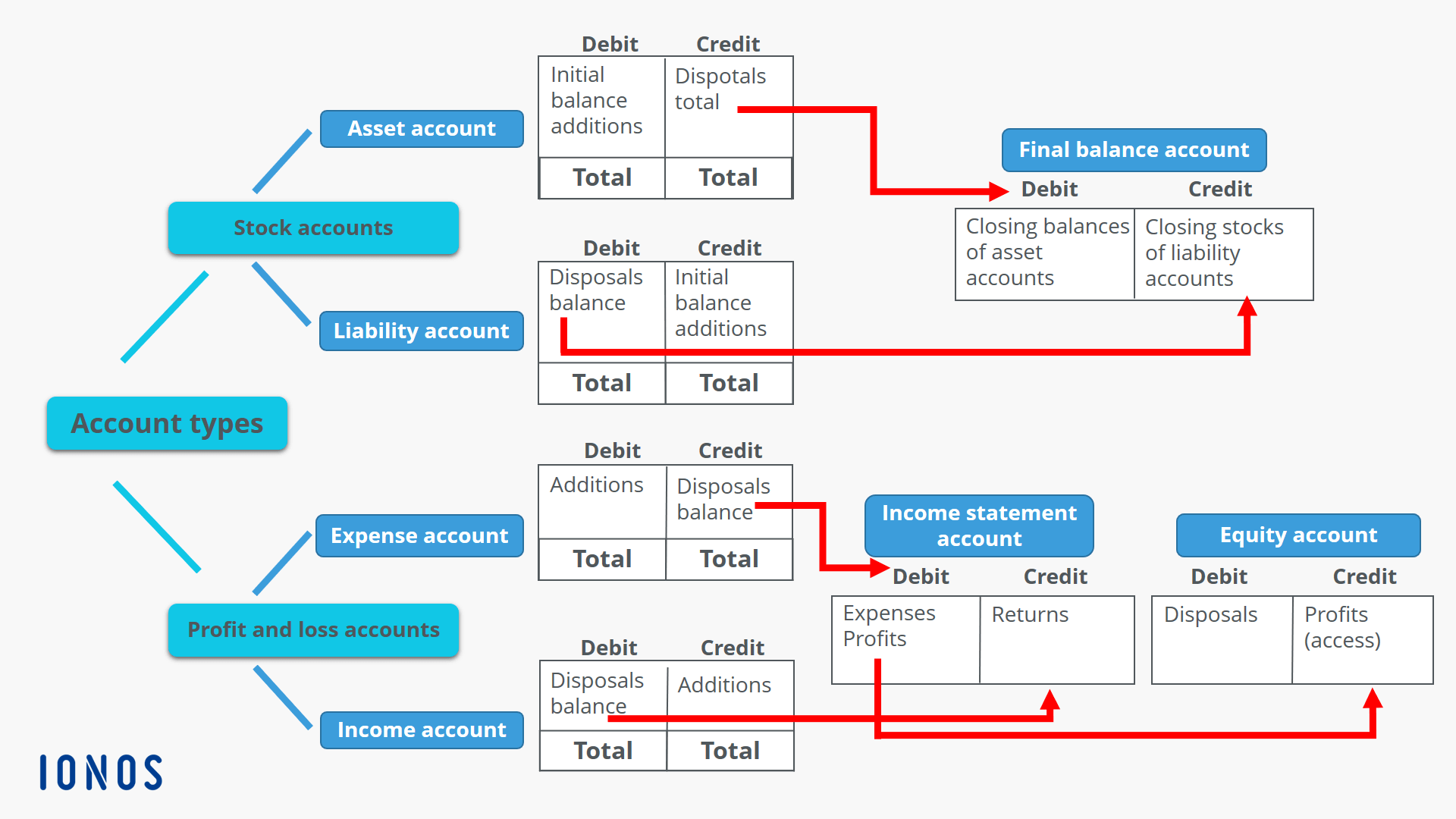

Double Entry Bookkeeping

Debits and credits are bookkeeping entries that balance each other out. In a double-entry accounting system, every transaction impacts at least two accounts. If you debit one account, you have to credit one (or more) other accounts in your chart of accounts. There is also a separate entry for the sale transaction, in which you record a sale and an offsetting increase in accounts receivable or cash. A sale transaction should be recognized in the same reporting period as the related cost of goods sold transaction, so that the full extent of a sale transaction is recognized at once. If you are operating a production facility, then the warehouse staff will pick raw materials from stock and shift it to the production floor, possibly by job number.

Journal Entry (with Debit and Credit Examples)

However, managing debits and credits manually can be time-consuming and prone to errors. Managing debits and credits by hand can take up a lot of time and leave room for mistakes. With just a few clicks, the software handles both sides of your transactions. For example, when you record a sale, it automatically debits your cash or accounts receivable and credits your revenue account, so you don’t have to do it manually. There is no upper limit to the number of accounts involved in a transaction – but the minimum is no less than two accounts.

Finally, when you finish the product using the raw materials, you need to make another journal entry. Liabilities, equity, and revenue increase with credits and decrease with debits. Debits boost your asset accounts because they represent a gain in resources.

These fundamental principles are at the heart of double-entry bookkeeping, the backbone of accurate accounting. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

Asset, liability, and equity accounts all appear on your balance sheet. Debits and credits are a critical part of double-entry bookkeeping. They are entries in a business’s general ledger recording all the money that flows into and out of your business, or that flows between your business’s different accounts.

If you understand the components of the balance sheet, the formula will make sense. Additionally, holding onto inventory for too long could lead to obsolescence or spoilage. Companies risk losing money if they are unable to sell outdated products before they expire or become irrelevant. Another pro of inventory is that it can provide a buffer against supply chain disruptions or unexpected spikes in demand. By having extra stock on hand, companies can continue to meet customer needs even if there are delays or shortages from suppliers. For example, if Lisa runs a beauty store and decides to purchase 40 lipsticks at the beginning of the year for $10 each, to sell to customers.

On the other hand, a credit is an entry made on the right side of an account. It indicates that something has been subtracted from one account or added to another. If you buy $100 in raw materials to manufacture your product, you would debit inventory debit or credit your raw materials inventory and credit your accounts payable. Once that $100 of raw material is moved to the work-in-process phase, the work-in-process inventory account is debited and the raw material inventory account is credited.

This is because credits increase the value of your inventory, making it easier to see how much you have on hand at any given time. Additionally, if you use a first-in-first-out (FIFO) method for tracking inventory costs, crediting can help ensure that newer items are assigned higher values than older ones. Inventory is a term used to describe the goods and materials that a business holds in stock for sale or production. It includes raw materials, finished products, work-in-progress items, office supplies, and any other assets that are available for use or resale.

Your business’s inventory includes raw materials used to create finished products, items in the production process, and finished goods. This might happen if you adjust or reverse the expenses you previously recorded. For example, For example, let’s say you were charged for a service you didn’t end up using, and the vendor issued a refund. You would credit the expense account for that service to reflect the refunded amount. For example, let’s say you need to buy a new projector for your conference room. Since money is leaving your business, you would enter a credit into your cash account.

.jpeg)

Bình Luận